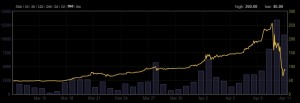

I’ve been following bitcoins pretty closely for the past ten days now and the market has been insanely volatile and highly entertaining. Here’s the chart

It’s gone from $50 to $260 all the way back to $60 in the past thirty days. I first heard about bitcoins a couple years ago back in 2011. I got a couple free ones from the bitcoin faucet and played around with them for a bit. I thought they were interesting, but ultimately useless unless they gained widespread adoption. Well lately, as a result of the crazy price increases they’ve been all over the news and some legitimate merchants have started accepting them. Some people think it’s a bubble, some call it a pyramid scheme, some think they’ll be worth hundreds of thousands of dollars one day. Whatever your opinion it’s been a wild ride lately. The TV news interviews you see about them are obviously done by people completely clueless about them, however, and they always have these two very basic questions so for you newbies out there I’ll go ahead and answer them for you.

What are bitcoins?

Bitcoins are basically just numbers stored in a database(blockchain) linked to a bitcoin address. Similarly, dollars are just numbers stored in a database linked to a bank account.

Can’t some hacker just create a bunch of bitcoins?

No. Creating bitcoins requires a tremendous amount of computing power. Just how no human can multiply two 100 digit numbers in their head, a single computer can’t just magically create a bunch of bitcoins.

Differences between dollars and bitcoins

1. Fixed supply

Only 21 million bitcoins will ever exist. The number of US dollars that can ever exist is infinity.

2. Money supply over time

The numbers of both currencies is constantly changing, however, bitcoins follows a fixed predictable schedule. As of April 11, 2013 there are 11,022,500 bitcoins and something like 10 trillion US dollars. In 2014 there will be 11,812,500 bitcoins. In 2020 there will be 17,718,750 bitcoins. I have no idea how many US dollars will exist next year, or ten years from now. Nobody does. The federal reserve controls and manipulates the money supply daily. They increase or decrease the money supply by changing bank reserve requirements, buying or selling T-bills, or changing the discount rate.

3. Issuing authority

All dollars are ultimately created by the federal reserve. All bitcoins are created by thousands of individual bitcoin miners. No one miner is in control. Right now about 3600 new bitcoins are created a day. Miners do pool their resources into various mining pools, but no miner pool can ever reach 51% of the hash power or there will be problems.

Pros of bitcoins

1. 24/7 Speedy Service

Bitcoin transactions can happen anywhere, anytime and be confirmed within 10 minutes usually. Normal banks are open 9am-5pm Monday through Friday and transactions usually take 1-2 business days to become confirmed.

2. Low Transaction Fees

Bitcoins transaction fees are 0.0005 BTC per transaction(okay not exactly, but pretty much, click the link for more details). At $100 USD/BTC that’s equivalent to five cents. A normal credit card transaction will cost the merchant a 3% fee with a minimum fee of 25 cents. A typical wire transfer costs $25 send and sometimes a fee on the receiving end as well.

3. Everyone has a merchant account

If you want to start accepting bitcoins all you need is a bitcoin address. You don’t have to be approved by a credit card company and pay them fees once you are accepted. It’s as simple as pasting people your bank account number(bitcoin address) and you’re good to go.

4. Ease of transport

If you want to carry $20k in cash with you to Vegas it’s risky. You can lose it, someone can rob you, and authorities can confiscate it and there’s not much you can do about it. Just ask Viffer With bitcoins you just need to remember a password and that’s all you really need.

5. No Chargebacks

If you sell an item on ebay and accept paypal money, confirm the shipment, but the customer says they never received it, or lies and says it’s broken and paypal will issue a refund and you are out your money or item and there’s not much you can do about it. Bitcoins are one way transactions and irreversible(pretty much).

Cons of bitcoins

1. No Chargebacks

If someone steals your credit or debit card number you can call up your bank and get your fraudulent transactions reversed. If someone steals your bitcoin wallet there’s not much you can do. That’s why keeping your bitcoin private key secure and encrypting your wallet is so important.

2. You can delete bitcoins

Sure you can burn dollars too, but no one accidentally does that. If you lose your wallet your money is gone. Ever had a hardrive crash? Ever accidentally deleted a file you weren’t supposed to? Backups are important.

3. If your computer gets hacked you can lose all your money

If you visit the wrong website or open the wrong e-mail attachment you can lose all the money in your account. This is very scary stuff. Backups and security are your friend. Bank level security is wonderful and has had many, many years to mature. Bitcoins have existed for four years now. It’s going to take awhile(maybe never) for systems to emerge for the average joe to feel comfortable putting money into bitcoins.

4. Not many merchants accept bitcoins

This may change in the future, and new merchants sign up daily, but right now if you want to buy something with bitcoins you pretty much have to convert bitcoins to USD which makes the whole thing pretty pointless.

5. High volatility

Price stability is important for bitcoins to succeed in the long run. No one wants their money to be worth 50% of what it was worth yesterday. The US dollar fluctuates maybe 3% a year vs most other currencies. In the short run speculation will drive price, but bitcoin will need to eventually become lower volatility for it to ever work as a legitimate currency.

6. Hoarding

Due to the fixed supply of bitcoins they are susceptible to hoarding. If their coins are worth more tomorrow then they are today why would people spend them or invest them in other commodities? Well, US dollars used to be based on the gold standard and there is a fixed amount of gold on the planet. People still spent US dollars just fine. It’s all a matter of how much the value of BTC increase over time. A deflationary spiral is definitely possible and could create bubbles like we’re possibly seeing now, which could ultimately undermine confidence in bitcoins as a currency.

Links:

Bitcoin market watch:

Bitcoinity

Clark Moody

Bitcoin clients:

Lightweight client Electum

Full blockchain client Bitcoin-qt (Requires about 6 GB of space and won’t work til you download and sync with the full blockchain)

Buy bitcoins:

Warning: Don’t buy bitcoins unless you are prepared to lose all your money. They are highly volatile right now and you have to be very careful you don’t lose them or get hacked.

Largest online exchange MtGox.com

Smaller Online exchange BitStamp.net

Trade cash for bitcoins from locals LocalBitcoins.com

The easiest, quickest and cheapest method will vary depending on what site/method you use. For an online exchange the quickest and easiest is probably to do an international wire transfer directly to them. It will cost you ~$25 + receiving end fees. You can also try going through Bitinstant (Reviews are mixed) or Dwolla (takes awhile to get verified and link your account)

Create a secure offline bitcoin paper wallet:

http://www.youtube.com/watch?v=JsyPfiENwQU

Warning: Before using a paper wallet read this

Bitcoin Poker:

Seals with Clubs

-EV casino gambling

Satoshi Dice

Bitcoin mining:

Don’t even bother

Donate to me: 18m2XtF55Yu5XZ14KakSS6ZrcdsVoSkHgb